Kicking off with humana medicare supplement insurance plans, this opening paragraph is designed to captivate and engage the readers, setting the tone formal and friendly language style that unfolds with each word.

Humana Medicare Supplement Insurance Plans offer a wide range of coverage options and benefits for those looking to enhance their Medicare coverage. From detailed coverage descriptions to cost breakdowns, this guide will explore all facets of Humana’s offerings in the realm of Medicare supplement insurance.

Overview of Humana Medicare Supplement Insurance Plans

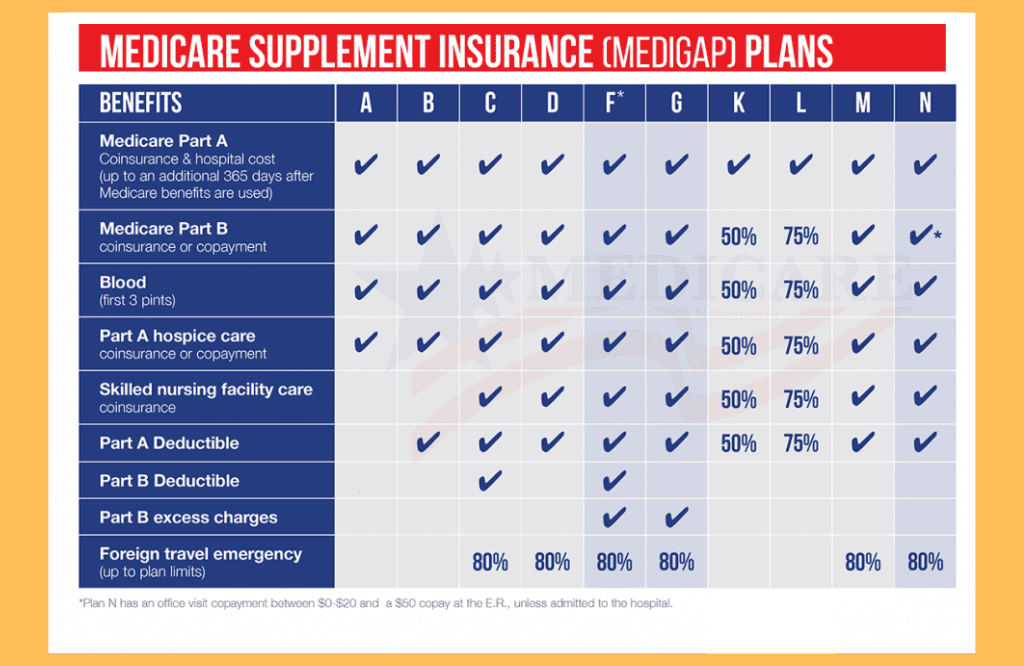

Humana Medicare Supplement Insurance Plans provide additional coverage to fill the gaps left by Original Medicare. These plans, also known as Medigap plans, help cover costs such as copayments, coinsurance, and deductibles that Medicare doesn’t pay for.

Types of Humana Medicare Supplement Insurance Plans

- Humana Plan A: Basic benefits covering Medicare Part A and B coinsurance.

- Humana Plan F: Comprehensive coverage including foreign travel emergency care.

- Humana Plan G: Similar to Plan F but without coverage for the Medicare Part B deductible.

Eligibility and Enrollment Process

To enroll in Humana Medicare Supplement Insurance Plans, you must be enrolled in Medicare Part A and Part B. You can apply for a plan during your Medigap Open Enrollment Period, which starts when you’re 65 or older and enrolled in Medicare Part B.

Cost and Pricing Options

The cost of Humana Medicare Supplement Insurance Plans varies depending on the type of plan you choose and your location. Pricing is determined based on factors such as age, gender, and tobacco use. Humana offers competitive rates compared to other providers in the market.

Coverage and Benefits

Humana Medicare Supplement Insurance Plans cover a range of services including hospital stays, skilled nursing facility care, and hospice care. These plans also offer coverage for certain preventive services not covered by Original Medicare.

Network Coverage and Providers

Humana has a wide network of healthcare providers and facilities, giving you the flexibility to choose your preferred doctors and hospitals. With Humana Medicare Supplement Insurance Plans, you can receive care from any provider that accepts Medicare patients.

Customer Reviews and Satisfaction

Customers have praised Humana for its excellent customer service and comprehensive coverage options. Overall, satisfaction levels with Humana’s Medicare Supplement Insurance Plans are high, with many customers appreciating the peace of mind these plans provide.

Additional Features and Services

In addition to Medicare supplement coverage, Humana offers wellness programs, discounts on vision and dental services, and access to a 24-hour nurse advice line. These extra features enhance the overall value of choosing Humana for your Medicare supplement insurance needs.

Closure

In conclusion, Humana Medicare Supplement Insurance Plans stand out for their comprehensive coverage, flexible network options, and additional services that enhance the overall value for customers. Whether it’s customer reviews or a detailed breakdown of costs, this guide provides a holistic view of what Humana has to offer in the realm of Medicare supplement insurance.

Key Questions Answered: Humana Medicare Supplement Insurance Plans

Who is eligible to enroll in Humana Medicare Supplement Insurance Plans?

Individuals who are already enrolled in Medicare Part A and Part B are eligible to enroll in Humana Medicare Supplement Insurance Plans.

How are pricing and costs determined for Humana Medicare Supplement Insurance Plans?

Pricing for these plans is determined based on various factors including age, location, and the specific plan chosen. Discounts may be available for certain criteria.

What additional features and services does Humana offer along with their Medicare Supplement Insurance Plans?

Humana provides wellness programs, discounts, and other added benefits to complement their Medicare Supplement Insurance Plans, enhancing the overall value for customers.